Mergers & Acquisition Strategies

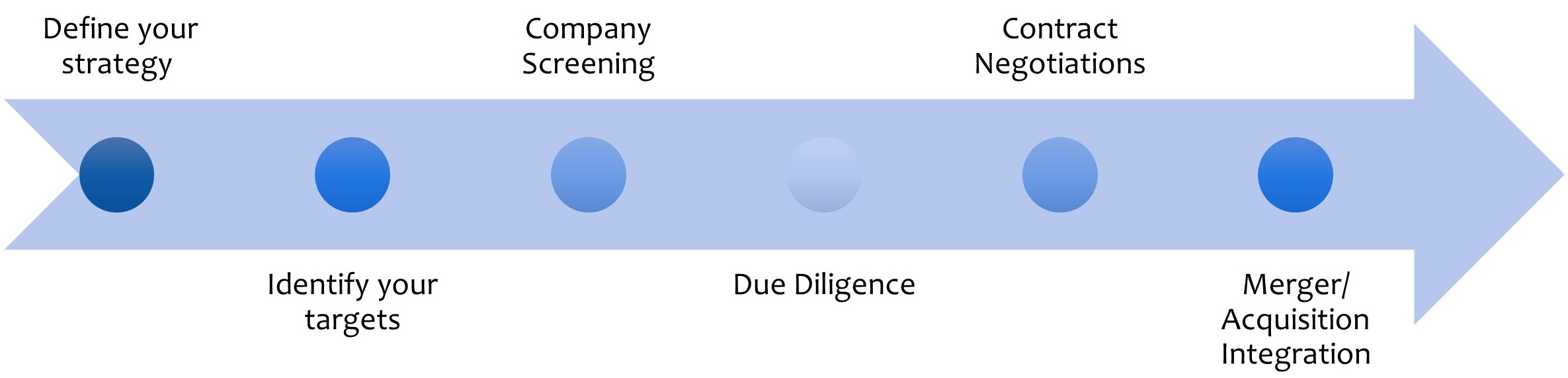

Because bigger companies are generally more valuable and easier to sell than smaller ones, more businesses should consider merger and acquisition strategies to achieve economies of scale and growth. If organic growth is slow, finding strong company mergers or acquisition companies targets will help unlock the advantages of expansion or breaking into new markets. Our role is to assist you identify the best market strategies; sourcing suitable targets; facilitating the funding of your M & A programme and co-ordinating the whole process of acquisition management from start to finish, including its implementation. Our 6-step approach to M&A below has proven very effective over the years. Additionally, we have written several comprehensive articles that you can access such as “Taking the A out of M&A” and “Do You Need To Acquire Companies To Hit Your Growth Objectives?”

``M & A research shows that companies that actively acquire others, consistently deliver higher shareholder returns than those that don’t, with companies that regularly and systematically acquire, performing best of all.`` Philip Waxman

Why Choose to Grow by Acquisition?

- Mergers can often be cash/debt free as they result in a share reallocation in the merged business

- An excellent way of breaking into new markets or gaining critical market mass

- Economies of scale will follow

- More consistent growth is achievable through targeted or bolt-on acquisitions

- Often they are funded from cashflow or deferred consideration

Our Successful Track Record of Mergers & Acquisitions

- Ridgetown personnel have supported clients for 25+ years on over 25 Mergers and Acquisitions

- Mergers we have handled have generally exceeded client expectations

- ICAEW qualified specialists with many years experience

- We have both advised clients and working at Board level for acquisitive Groups

- Our expertise helps refine your acquisition process

What Are the Advantages of Working With Us?

- Extensive corporate finance and private equity expertise

- We support your M&A process with knowledge based on extensive research, industry benchmarking and in-depth financial analysis

- We understand the key aspect of funding in M & A deals

- We focus on synergy, avoiding one of the main reasons for M & A failure

- Creating an M & A blueprint– Successful acquirers develop a repeatable formula that has a systematic and rigorous approach

- Improve your chances of a successful deal. We make sure you have the M & A strategy and capabilities to support your growth ambitions