Business Funding Support

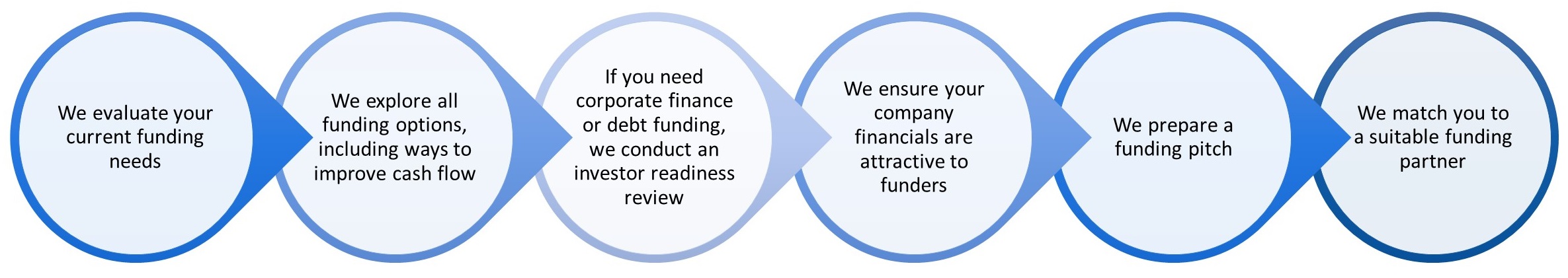

Becoming Investor Ready is a vital part of getting the business funding that you require, but how do you do it? Ridgetown have a “6 steps to investor readiness” blog post that you will find instructive and very much puts you in control. It is a process of financial business planning that starts with a realistic assessment of your corporate ambitions and evaluates both the current and future financial help for your business. It then explores all aspects that investors look for to de-risk their loans such as financial business planning systems, management and strategic financial planning. It looks at the most suitable funding required by the company, whether it is debt, equity or a hybrid of the two. We achieve this by preparing a detailed strategic financial plan that sets up your funding pitch to answer and impress funders. When you have a choice of investors that are prepared to lend to your business, you need financial help to choose the most appropriate partner at the most competitive rate. We support you throughout the business funding process as an integral part of your team.

What Are The Benefits?

-Investment funds are out there if you know how to access them

-Obtaining business investment is much easier with a solid plan in place

-You are more likely to secure lower cost business lending

-We help you avoid contractual pitfalls in the investment process

-We prioritise debt ahead of equity funding

Answering Your Questions

How do we help you to attract funding?

- We carefully evaluate your financial goals

- We ensure your financial accounts are fundable

- We explore the best options for your investment needs

- We present your growth plan to win the funding you require

What funding options can we offer?

- Raising debt without giving away equity

- Invoice Discounting

- Bank loans and overdrafts

- Grants and R&D incentives

- Crowd funding

- Angel investors

- Private Equity

What makes you more likely to obtain investment?

- Solid financials and a proven track record

- An achievable and well presented growth plan

- An experienced management team

- A clear strategy and realistic expansion vision

Our Funding Acheivements

135

£,000 Average amount we raised

46

£ Millions we have raised

118

Companies we have helped to fund

Key Funding Achievement: Intelling Group

Intelling - We helped secure several million pounds of inward investment for the business which helped transform working capital and it's ability to exploit growth opportunities. The business has grown over 350% over the last few years and shows no sign of slowing down.